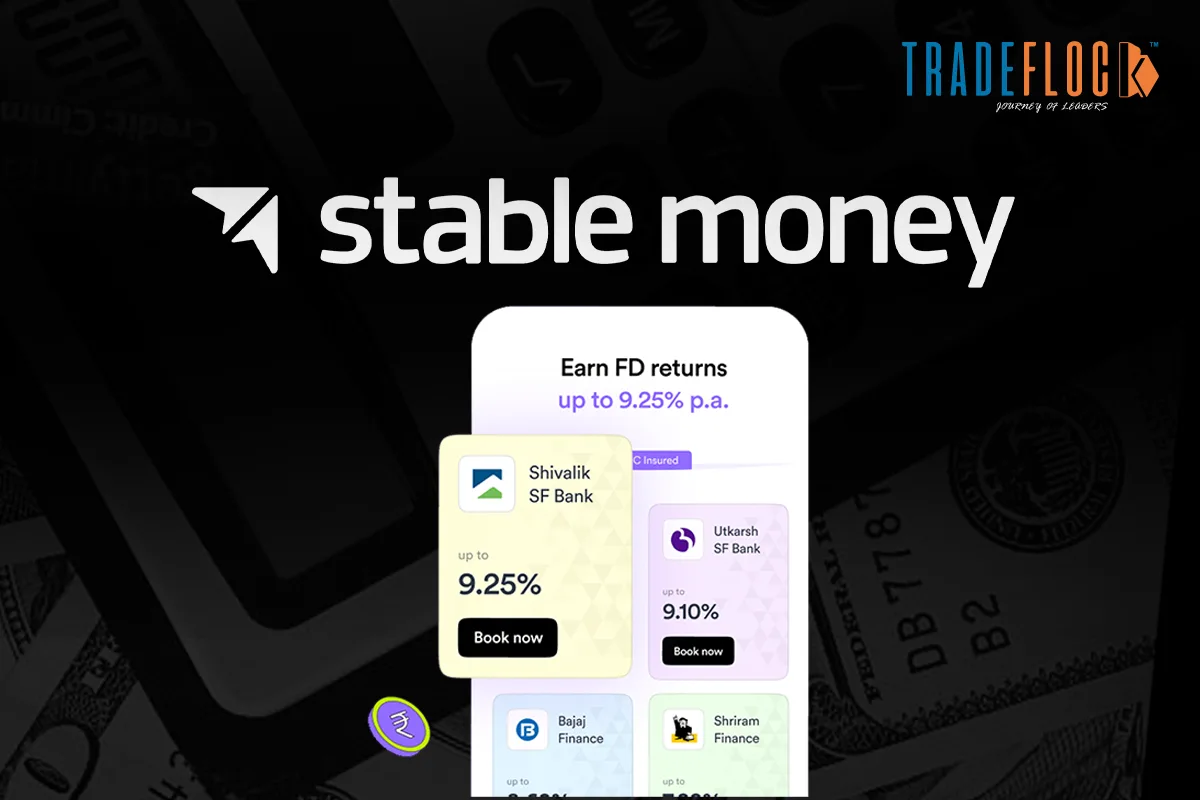

While equity tech and mutual fund aggregators dominate the market, Stable Money distinguishes itself by enabling individual investors to access fixed-return instruments directly from their mobile phones. Founded in late 2022 by experienced professionals Saurabh Jain and Harish Reddy, the company is based in Bengaluru. Saurabh Jain, previously at Swiggy and Navi Mutual Fund, collaborated with Harish Reddy, who has a background in brokerage at Estee, to identify a significant opportunity: fintechs are focusing on making equities accessible to everyone, but very few have addressed the gap in fixed-income products. Leveraging their expertise in both fund management and technology, Jain and Reddy aimed to create a platform that allows individuals to compare and manage various types of investments in just a few minutes on their phones.

Table of Contents

Simplifying Safe Investments

Stable Money strives to make India’s fixed-income market more transparent, give people more choices, and make things simple for investors. Since FDs satisfy risk-averse investors due to their safe principles, the platform decides to transform how customers deal with these investments.

- Users easily view interest rates along with details on tenures from many banks and NBFCs using the platform, which saves their valuable time.

- Applications and Payment: You do not need to open another account for your investment; the money you receive or have to pay will be handled by partner banks.

- With such a low minimum, Stable Money lets every investor, especially the new ones, put their money into safe investments.

Development of Technologies

Basically, Stable Money is a mobile application that brings together fixed-income options regulated by the RBI. These programs are known for possessing important features.

- Now, you can stay online and book a foreign currency account without having to use physical paperwork or visit a branch.

- A dashboard shows all details of maturity dates, the interest paid, and your complete accumulated return in one place.

- By getting alerts through the system, users can decide on new investments before a rate or maturity change.

- Explanations and information regarding debt products are available for users to learn from.

Since it only focuses on fixed-income assets, Stable Money hopes to become the first choice for anyone interested in steady, slow-growth investments.

Increase agreements with partners and focus on company growth.

Upon its start, the company tried to partner with banks and NBFCs to be able to sell their products and earn distributions. Starting in mid 2024, Stable Money already had several important lenders on board, and aimed to bring 25 financial institutions on board by March 2025. In addition to offering many products, they also earn extra money by charging every time their services are needed.

Users were first attracted to the app through friends’ advice, posts found online, and advertising the company designed. During its first year, people from different parts of the globe started turning to it as a safer way to invest in equities.

Funding Milestones

Stable Money has attracted major investors, who realise how important fixed-income digitisation could be.

- Pre-Series A fundraising round is valued at $5 million and is expected in August 2023.

It is being led by Matrix Partners and Lightspeed and supported by Titan Capital, Mar Shot Ventures, and by Kunal Bahl (Snapdeal) and Sriharsha Majety (Swiggy). In this round, development of the product and first links to banks were completed.

- Another round of investment came in Series B for $20 Million, in June 2025.

This round was “flat” and included Fundamentum, which is what Nandan Nilekani and his team founded, as well as Aditya Birla Ventures and the earlier participants Z47, RTP Global, and Lightspeed. This points to investors’ confidence in Stable Money as it keeps increasing its users and collaborating with more institutions.

- Despite having only a handful of employees, the startup has used its resources carefully, focusing on technology, sticking to regulations, and looking for partners, to help the company increase its market share without lowering its unit economics.

Competitive Landscape

While established brokers like Groww, Zerodha, and traditional banks offer FDs as part of broader portfolios, none focus solely on fixed-return products. This specialisation gives Stable Money a clear value proposition, though it also exposes the company to challenges:

- Some complaints about not receiving refunds on time have appeared online, which means the company needs to improve customer service and open up its refund procedures.

- Pressure on Margins: Since fintech models keep changing, it will be necessary to negotiate fair rates with banks and consider how to satisfy customer demands.

- Fulfilling the RBI’s rules for mandates and payouts requires companies to adhere to them constantly.

It is believed that Stable Money’s success is connected to its ability to strengthen bank collaborations, guarantee platform stability, and continue sharing the benefits of fixed-income distributing.

Reinventing Fixed-Income Investing

In the future, Stable Money focuses on accomplishing the following goals:

- Introduce 40-plus banks and NBFCs by the end of 2025 to ramp up available products.

- Improve the tech stack by offering AI-driven forecasting of interest rates, automatic portfolio management, and quick client verification.

- Bring in Other Securities: Start selling debt mutual funds, municipal bonds, and international fixed-income agreements.

- Enhance Customer Engagement: Implement personal advisory, community forums, and valuable analytics for users with high net worth.

India’s fixed deposits exceed $404 billion annually, presenting vast potential for digital technology in this sector. If Stable Money maintains its focus and customer service, it will lead as the nation’s wealthtech platform.

The evolution of Stable Money highlights the Indian fixed income market’s potential. By blending traditional security with cutting-edge technology, the startup aids conservative investors and fosters fintech growth. With enhanced collaborations, advanced technology, and trusted customers, Stable Money aims to transform saving and investment in India for the future.