Have you been keeping track of the progress within the satellite internet revolution?

Starlink is revolutionizing telecommunications by competing with existing internet service providers and disrupting their traditional business model. Speculation about Starlink’s upcoming IPO has captured the interest of international investors.

What makes Starlink different is simple:

- Global coverage through a massive satellite constellation

- High-speed internet in previously unreachable locations

- The success of Starlink is enabled through Elon Musk’s support and the innovative track record established by SpaceX.

Because of Starlink’s quick growth trajectory we must examine how it will shape telecommunications markets and influence investment decisions.

Table of Contents

What You Need to Know:

- What Exactly Is Starlink?

- The Impressive Growth Numbers

- Starlink’s Performance Statistics

- Pre-IPO Investment Considerations

- Challenges and Opportunities Ahead

What Exactly Is Starlink?

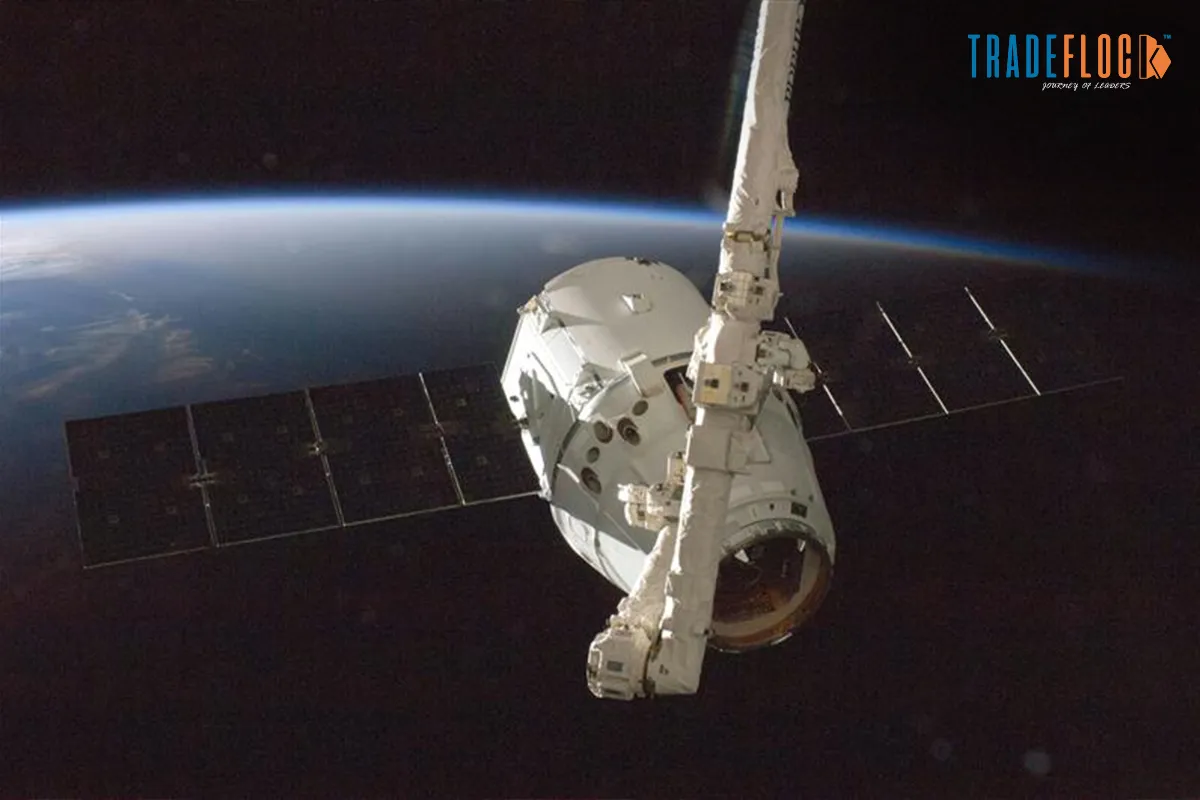

SpaceX has developed Starlink satellite internet network to provide worldwide high-speed internet with minimal latency. Thousands of small satellites operating in low Earth orbit enable Starlink to deliver internet services with higher speeds while reducing latency beyond what traditional providers offer.

The core mission? Connect the unconnected.

The establishment of internet connectivity using traditional infrastructure requires expensive physical cable and equipment installations throughout distant regions. Through space-based direct internet transmission Starlink resolves traditional internet delivery obstacles.

Starlink’s advanced system provides internet access to locations that traditional telecom companies find too expensive and logistically challenging to serve.

Why this matters:

Starlink became the only realistic internet service provider solution for millions of customers worldwide because its initial focus was on reaching underserved markets instead of challenging established providers.

The Impressive Growth Numbers

Industry analysts and potential investors focus their attention on Starlink’s operations because its expansion rate displays extraordinary growth.

The subscriber growth tells an impressive story. The global subscriber count for Starlink increased from 2.69 million in April 2024 to 5.5 million by April 2025 through rapid expansion. Starlink’s subscriber base keeps growing at a steady pace by doubling its size yearly.

Starlink demonstrates superior expansion capabilities compared to most traditional telecom firms which reflects strong market demand along with its operational efficiency.

The financial numbers reveal themselves to be equally extraordinary. Starlink achieved over USD 3.2 billion in revenue during fiscal year 2024 and exceeded 5.4 million subscribers by March 2025.

This growth isn’t happening in a vacuum. The Starlink internet stock and valuation has become a hot topic among investors looking to get in early on what could become one of the most significant telecommunications players of the decade.

The company extends its service availability to international customers by improving coverage and performance metrics and reducing equipment expenses over time.

Pre-IPO Investment Considerations

The investment community is becoming increasingly interested in Starlink because people speculate that its upcoming IPO may become the telecommunications industry’s most significant public offering.

Here’s what potential investors should know:

Starlink functions as a separate business unit inside SpaceX that facilitates its progress toward an eventual IPO. Starlink’s independent business structure enables investors to focus on its distinct value proposition.

The pre-IPO phase presents businesses with both possible advantages and risks.

- Potential for substantial growth as Starlink expands its constellation

- First-mover advantage in the next-generation satellite internet market

- Technology leadership backed by SpaceX’s innovation capabilities

- Regulatory uncertainty across different global markets

- Competition from emerging LEO constellations

Elon Musk indicated that Starlink will go public when revenue growth shows a consistent pattern. The growing subscriber base suggests an impending milestone yet there is no official schedule available.

Investors exploring pre-IPO options must grasp the distinctive market position that Starlink occupies. Starlink stands apart from other telecom businesses due to its dual role as an infrastructure supplier and service provider which may result in distinctive expansion trends.

Challenges and Opportunities

Despite facing significant obstacles Starlink demonstrates substantial potential typical of any disruptive technology.

Key challenges include:

Regulatory Hurdles

Starlink must navigate through various regulatory systems while expanding its operations worldwide. Telecommunication companies must follow unique regulatory demands and spectrum distribution rules which change from one country to another.

Some nations maintain skepticism about Starlink while other countries treat it as vital infrastructure. Starlink faces market growth challenges due to fragmented regulatory environments in different regions.

Technical Limitations

Despite progress, Starlink still faces technical challenges:

- Satellite lifespan is relatively short, requiring constant replacement

- Spectrum constraints may limit bandwidth as the constellation grows

- Space debris concerns increase as more satellites are launched

- Weather sensitivity affects service reliability

Competition

Several enterprises are launching their own LEO satellite internet services to directly challenge Starlink’s market position.

- Amazon’s Project Kuiper

- OneWeb’s satellite constellation

- Traditional telecommunications companies expanding satellite offerings

Major opportunities include:

Expanding Market Reach

Starlink establishes internet access in locations that lacked prior connectivity which results in new market opportunities.

- Rural and remote regions where traditional infrastructure is unfeasible

- Developing nations with limited telecommunications infrastructure

- Maritime and aviation markets requiring connectivity

- Disaster recovery services

Technology Integration and Enterprise Contracts

Starlink offers more than basic internet access by integrating with IoT networks and 5G technologies along with edge computing systems and its enterprise contracts boost military communications and remote operations which include education and healthcare sectors.

The Road to IPO

Understanding Starlink’s path towards public markets is essential for investors who are observing its development during pre-IPO stages.

SpaceX implemented a systematic approach to ready Starlink for its upcoming public offering. Before entering the marketplace the company worked to develop a sustainable business model.

Key factors influencing Starlink’s IPO timeline:

- Achieving profitability – Musk has indicated Starlink needs to demonstrate consistent profitability first

- Completing the initial constellation – Having enough satellites for reliable global coverage

- Stabilizing subscriber growth – Establishing predictable growth patterns

- Resolving regulatory challenges – Securing approvals in major markets

Potential investors can evaluate Starlink’s readiness for public markets by tracking their progress through these important milestones.

Final Thoughts: The Big Picture

Starlink represents a pioneering telecommunications project in modern times that promises to transform global internet access.

Starlink’s innovative approach bypasses conventional infrastructure limitations enabling it to provide internet access to regions that traditional telecom companies cannot reach. The expansion will include billions of new users into the worldwide digital economy.

Starlink combines investment-worthy features which make it an intriguing investment opportunity.

- SpaceX’s proven technology leadership and ability to reduce launch costs

- Strong brand association with Elon Musk’s track record of disruption

- First-mover advantage in the next generation of satellite internet

- Vertical integration controlling both infrastructure and service delivery

Even though Starlink faces many challenges its continuous growth indicates its capacity to become an industry leader in telecommunications for the coming decades.

Pre-IPO investors can leverage Starlink’s advanced technology and market disruption capabilities along with its global scalability to make it an exceptional telecommunications public offering option.